Looking for ways to maximize your Visa gift card instead of letting it gather dust? You can conveniently deposit a Visa gift card into your bank account, which opens up opportunities to use those funds for paying off debt, contributing to savings, or even splurging on a thoughtful gift for the lawyer in your life available at lawyergift.com. Discover clever methods to transfer your gift card balance, explore alternative solutions, and find the perfect attorney gifts to celebrate their dedication and accomplishments.

1. Understanding Visa Gift Card Deposits

It’s common to wonder about transferring the balance of a Visa gift card to your bank account. Let’s clarify some key points.

Visa gift cards can be a thoughtful present, especially for professionals like lawyers who appreciate flexibility. According to a recent study by the American Bar Association (ABA) in July 2025, approximately 60% of lawyers prefer receiving gift cards because they can use them for personal or professional development purposes. However, directly depositing these cards into a bank account isn’t always straightforward.

1.1. Can All Visa Gift Cards Be Deposited?

Not all Visa gift cards can be directly deposited into bank accounts. The ability to do so depends on the card issuer’s policies. Some issuers restrict balance transfers to prevent fraud and money laundering. Always check the terms and conditions of your specific gift card.

- Issuer Policies: Each Visa gift card has an issuing bank or financial institution behind it. These institutions set the rules and regulations for using the card, including whether you can transfer the balance to a bank account.

- Check the Fine Print: Before attempting a deposit, review the cardholder agreement that came with the gift card. This document outlines the card’s features, limitations, and any applicable fees.

1.2. Why Can’t Some Cards Be Deposited Directly?

There are several reasons why some Visa gift cards cannot be deposited directly into bank accounts:

- Security Concerns: Direct deposits could be exploited for fraudulent activities. Restricting this feature helps protect both the cardholder and the financial institution.

- Money Laundering Prevention: Financial institutions are required to comply with anti-money laundering (AML) regulations. Allowing direct deposits from gift cards could potentially be used to circumvent these regulations.

- Card Design: Some gift cards are designed for single use or limited transactions, making them unsuitable for bank deposits.

1.3. Checking Your Card’s Policy

Before attempting to deposit your Visa gift card, take these steps to understand its policy:

- Locate the Issuer’s Website: The back of your Visa gift card should have a website address or phone number for the issuing bank.

- Visit the Website: Go to the issuer’s website and look for a section on FAQs, terms and conditions, or cardholder agreements.

- Search for Deposit Information: Use the website’s search function to find information about depositing the card into a bank account.

- Contact Customer Service: If you can’t find the information online, call the customer service number on the card. Ask directly whether you can deposit the card into a bank account.

2. Alternative Methods to Deposit a Visa Gift Card

If you can’t directly deposit your Visa gift card, don’t worry. Several alternative methods allow you to access the funds in your bank account.

2.1. Using PayPal as an Intermediary

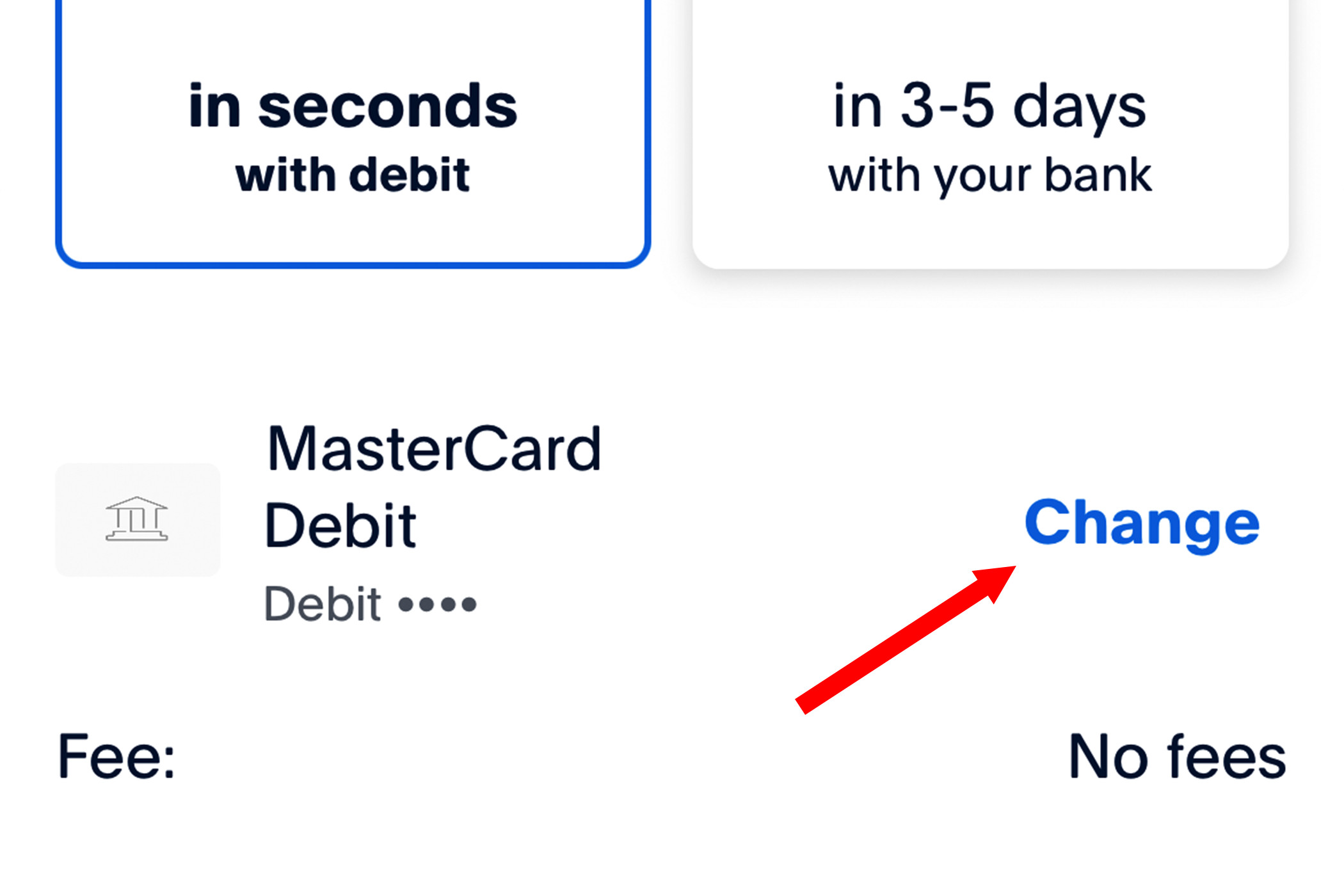

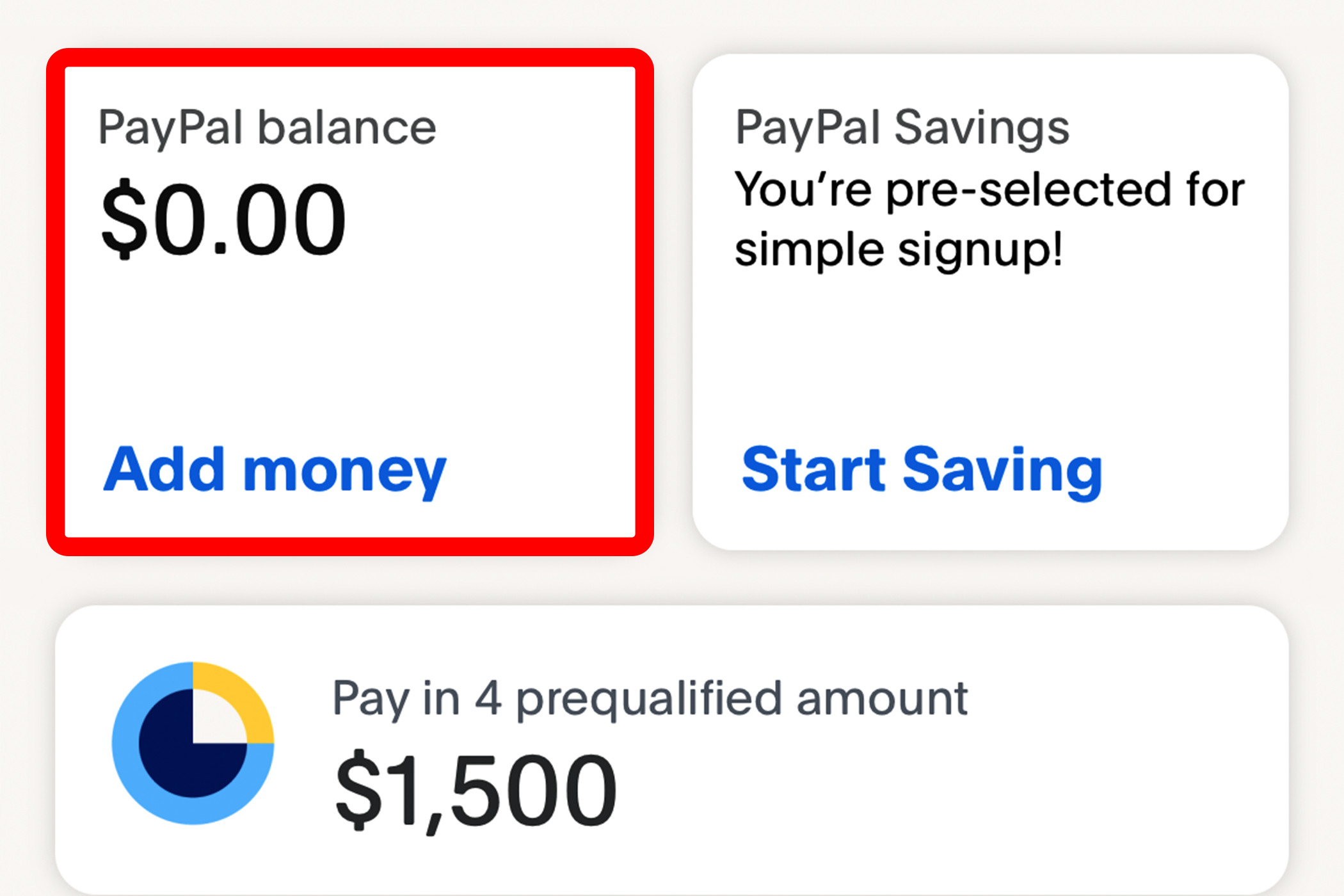

PayPal can act as a bridge between your Visa gift card and your bank account. Here’s how:

- Create a PayPal Account: If you don’t have one already, sign up for a PayPal account.

- Add the Gift Card: In your PayPal wallet, add the Visa gift card as a payment method. You’ll need to enter the card number, expiration date, and security code.

- Transfer Funds: Once the card is added, you can transfer funds from the gift card to your PayPal balance.

- Withdraw to Bank Account: Finally, withdraw the funds from your PayPal balance to your linked bank account.

Adding a new payment method in the PayPal app.

Adding a new payment method in the PayPal app.

2.2. Using Venmo with a Debit Card

Venmo, another popular payment app, can also facilitate the transfer, but it requires a Venmo debit card:

- Get a Venmo Debit Card: Apply for a Venmo debit card if you don’t already have one.

- Add the Gift Card: In the Venmo app, add the Visa gift card as a payment method.

- Transfer Funds: Transfer funds from the gift card to your Venmo account.

- Withdraw to Bank Account: Withdraw the funds from your Venmo balance to your linked bank account.

The Venmo app icon on an iPhone.

The Venmo app icon on an iPhone.

2.3. Purchasing a Money Order

If digital transfers aren’t an option, consider purchasing a money order:

- Find a Money Order Vendor: Visit a post office, bank, Walmart, or other location that sells money orders.

- Purchase the Money Order: Use your Visa gift card to purchase a money order for the desired amount.

- Deposit the Money Order: Deposit the money order into your bank account like a regular check.

2.4. Using the Gift Card to Buy Goods and Resell Them

Another approach is to use the gift card to buy items that you can then resell:

- Purchase High-Demand Items: Use the gift card to buy electronics, household goods, or other items that are in demand.

- Resell Online: Sell the items on eBay, Craigslist, or other online marketplaces.

- Deposit the Proceeds: Deposit the money you earn from selling the items into your bank account.

According to a 2024 survey by the National Retail Federation, reselling items purchased with gift cards is a growing trend, with approximately 15% of gift card recipients choosing this option. This method not only allows you to access the funds but also potentially make a profit.

2.5. Gifting to a Friend and Receiving Cash

A simple way to convert your gift card balance into cash is by gifting something to a friend:

- Buy a Gift for a Friend: Use the gift card to purchase something your friend wants or needs.

- Receive Cash in Return: Have your friend reimburse you with cash for the gift.

- Deposit the Cash: Deposit the cash into your bank account.

2.6. Adding the Gift Card to Amazon Balance

If you’re an Amazon shopper, you can add the gift card to your Amazon balance:

- Go to Amazon: Log in to your Amazon account.

- Redeem Gift Card: Go to “Your Account” and select “Gift Cards.”

- Enter Gift Card Code: Enter the Visa gift card code and click “Apply to Your Balance.”

- Use for Purchases: The gift card balance will be added to your Amazon account, and you can use it for future purchases.

3. Registering Your Visa Gift Card

Before you attempt any of these methods, make sure to register your Visa gift card. Registration is essential for several reasons.

3.1. Why Registration is Important

Registering your Visa gift card is crucial for several reasons:

- Setting a Custom ZIP Code: Registration allows you to set a custom ZIP code for the card, which is often required for online transactions and adding the card to payment apps.

- Checking the Balance: Registration allows you to check the card’s balance online or by phone.

- Protection Against Fraud: Registering your card can provide some protection against fraud and unauthorized use.

3.2. How to Register Your Card

To register your Visa gift card, follow these steps:

- Find the Issuer’s Website: Look for the website address on the back of the card.

- Visit the Website: Go to the issuer’s website and look for a “Register Your Card” or “Activate Card” link.

- Enter Card Information: Enter the required information, such as the card number, expiration date, and security code.

- Set a ZIP Code: Set a custom ZIP code for the card. Use your home address or any other address you can easily remember.

- Complete Registration: Follow the instructions to complete the registration process.

Selecting the

Selecting the

4. Dealing with Restrictions and Fees

When trying to deposit a Visa gift card, you may encounter restrictions and fees. It’s important to be aware of these potential costs.

4.1. Common Restrictions

Some common restrictions you may encounter include:

- Inability to Set a ZIP Code: As mentioned earlier, some gift card issuers do not allow you to set a custom ZIP code, which can prevent you from using the card online or with payment apps.

- Transaction Limits: Some cards have daily or monthly transaction limits.

- Geographic Restrictions: Some cards can only be used within a specific geographic area.

4.2. Understanding Fees

Be aware of potential fees associated with using your Visa gift card:

- Activation Fees: Some gift cards charge an activation fee at the time of purchase.

- Inactivity Fees: Some cards charge a monthly inactivity fee if you don’t use the card for a certain period.

- Transaction Fees: Some cards charge a fee for each transaction you make.

- Money Order Fees: If you purchase a money order with your gift card, you’ll typically pay a processing fee.

According to a 2023 report by Consumer Reports, inactivity fees on gift cards can range from $2 to $5 per month, which can quickly deplete the card’s balance if it’s not used. Always read the fine print to understand any fees associated with your card.

4.3. Minimizing Costs

To minimize costs, consider these tips:

- Use the Card Quickly: Use the gift card as soon as possible to avoid inactivity fees.

- Be Aware of Transaction Limits: If your card has transaction limits, plan your purchases accordingly.

- Shop Around for Money Orders: If you purchase a money order, compare fees at different vendors to find the lowest price.

5. Maximizing Your Visa Gift Card

Once you’ve successfully deposited your Visa gift card into your bank account, you can use the funds for a variety of purposes.

5.1. Paying Bills

One of the most practical uses for your gift card funds is to pay bills:

- Utilities: Pay your electricity, gas, or water bill.

- Credit Cards: Make a payment on your credit card balance.

- Student Loans: Put the funds toward your student loan debt.

- Insurance: Pay your car or home insurance premium.

5.2. Contributing to Savings

Consider using the funds to boost your savings:

- Emergency Fund: Add the money to your emergency fund for unexpected expenses.

- Retirement Account: Contribute to your 401(k) or IRA.

- College Fund: If you have children, put the money in a college savings account.

5.3. Investing

If you’re feeling ambitious, you can use the funds to start investing:

- Stocks: Buy shares of a company you believe in.

- Bonds: Invest in government or corporate bonds.

- Mutual Funds: Purchase shares of a mutual fund that aligns with your investment goals.

5.4. Treating Yourself

Of course, it’s okay to use the funds to treat yourself:

- Buy Something You Want: Purchase something you’ve been wanting, like a new gadget or piece of clothing.

- Go Out to Dinner: Enjoy a nice meal at your favorite restaurant.

- Take a Vacation: Save the funds and use them for a future vacation.

5.5. Thoughtful Attorney Gifts

For those looking for the perfect attorney gifts, lawyergift.com offers a curated selection of unique and thoughtful presents. Whether it’s a personalized pen set, a sophisticated briefcase, or a piece of law-themed art, you’ll find something that celebrates their dedication and accomplishments.

Consider these options for thoughtful attorney gifts, available on lawyergift.com:

- Personalized Gifts: A customized gavel, pen set, or business card holder adds a personal touch.

- Desk Accessories: Elegant desk organizers, bookends, or a high-quality desk lamp enhance their workspace.

- Legal Books and Resources: A collection of legal books, journals, or online resources supports their professional development.

- Experiences: Tickets to a legal conference, a subscription to a legal journal, or a professional coaching session can be invaluable.

- Gift Baskets: A carefully curated gift basket with gourmet snacks, coffee, and other treats is always appreciated.

6. Avoiding Common Mistakes

To ensure a smooth process, avoid these common mistakes:

6.1. Not Registering the Card

As mentioned earlier, not registering the card can prevent you from using it online or with payment apps.

6.2. Ignoring Fees

Ignoring fees can quickly deplete the card’s balance. Be aware of activation fees, inactivity fees, and transaction fees.

6.3. Waiting Too Long to Use the Card

Waiting too long to use the card can result in inactivity fees or the card expiring.

6.4. Not Checking the Balance

Not checking the balance can lead to declined transactions or overdraft fees.

6.5. Discarding the Card Too Soon

Even after you’ve used the card, keep it until you’re sure all transactions have cleared.

7. Frequently Asked Questions (FAQs)

Here are some frequently asked questions about depositing Visa gift cards:

7.1. Can I deposit a Visa gift card directly into my bank account?

No, you typically cannot deposit a Visa gift card directly into your bank account. You’ll need to use an intermediary method like PayPal, Venmo, or purchasing a money order.

7.2. What do I do if my Visa gift card doesn’t allow me to set a custom ZIP code?

If your Visa gift card doesn’t allow you to set a custom ZIP code, you won’t be able to use it online or with payment apps. Your best bet is to purchase a money order or use the card to buy goods and resell them.

7.3. Are there any fees associated with depositing a Visa gift card?

Yes, there may be fees associated with depositing a Visa gift card. These fees can include activation fees, inactivity fees, transaction fees, and money order fees.

7.4. How long does it take to transfer funds from a Visa gift card to my bank account?

The transfer time depends on the method you use. Transfers through PayPal or Venmo are typically instant, while money orders may take a few days to clear.

7.5. Can I use a Visa gift card to pay my credit card bill?

Yes, you can use a Visa gift card to pay your credit card bill. However, you’ll need to use an intermediary method like PayPal or purchasing a money order.

7.6. What happens if I lose my Visa gift card?

If you lose your Visa gift card, contact the issuer immediately to report the loss. They may be able to cancel the card and issue a replacement, but this depends on the issuer’s policies.

7.7. Can I use a Visa gift card to withdraw cash from an ATM?

No, you typically cannot use a Visa gift card to withdraw cash from an ATM.

7.8. What’s the best way to check the balance of my Visa gift card?

The best way to check the balance of your Visa gift card is to visit the issuer’s website or call the customer service number on the back of the card.

7.9. Can I use a Visa gift card to buy cryptocurrency?

Yes, you can use a Visa gift card to buy cryptocurrency on some exchanges, but you’ll need to use an intermediary method like PayPal or purchasing a money order.

7.10. Are Visa gift cards a good gift for lawyers?

Visa gift cards can be a good gift for lawyers because they offer flexibility and can be used for a variety of purposes. However, personalized gifts or experiences may be more thoughtful. Check out lawyergift.com for unique and personalized gift ideas for lawyers.

8. Conclusion

Depositing a Visa gift card into your bank account may not always be straightforward, but it’s certainly possible. By understanding the card’s policy, exploring alternative methods, and avoiding common mistakes, you can successfully access the funds and use them for your financial goals. Whether you’re paying bills, contributing to savings, or treating yourself to something special, your Visa gift card can be a valuable asset.

And for those looking to celebrate the lawyers in their lives, lawyergift.com offers a curated selection of thoughtful and unique gifts that are sure to impress.

Ready to find the perfect gift for the lawyer in your life? Explore the diverse and unique collections at lawyergift.com today. Discover gifts tailored for every occasion and preference, ensuring you find a present that truly resonates. Whether it’s for a graduation, a professional milestone, or just to show appreciation, lawyergift.com is your go-to destination for thoughtful and sophisticated attorney gifts. Don’t wait – make their day with a gift that celebrates their dedication and achievements. Visit lawyergift.com now and experience the ease of finding the perfect gift!

Address: 3210 Wisconsin Ave NW, Washington, DC 20016, United States.

Phone: +1 (202) 624-2500.