Neiman Marcus, while known for its luxury and premium pricing, presents savvy shoppers with unique opportunities to score deals, especially through their recurring gift card events. For those familiar with reselling, these events, combined with strategic shopping portal usage, can become a lucrative avenue for generating rewards and even turning a profit. While these promotions can be maximized for cashback, mileage enthusiasts can also leverage them to bolster their balances. This guide delves into the mechanics of these events and outlines a strategy for resellers to make the most of them. If reselling isn’t your forte, this post might not be for you.

a blue and white striped background

a blue and white striped background

Alt text: Neiman Marcus Gift Card Event Advertisement with Striped Design

Why Neiman Marcus Gift Card Events Are Appealing

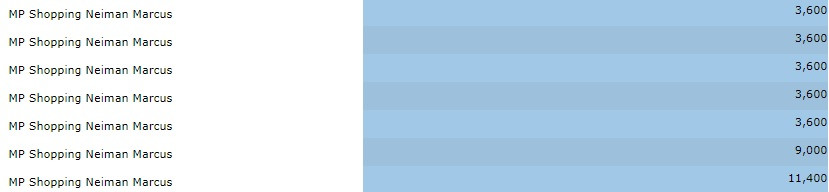

On the surface, Neiman Marcus might seem an unlikely place for deals due to its higher price points. However, by strategically combining promotional offers with cashback or mileage portals, significant savings become achievable, making reselling a viable option. These gift card events are a regular occurrence, often appearing almost monthly and spanning several days, though some are advertised as shorter, flash sales. The specifics of each event vary; some might require purchasing specific categories like handbags and apparel together, while others might exclude beauty and fragrance items. However, many events, like the one discussed here, apply to most items excluding clearance. Meeting specific spending thresholds during these events unlocks gift card rewards, typically delivered within eight weeks and valid for approximately two months from issuance.

a woman in a swimsuit

a woman in a swimsuit

Alt text: Summer Fashion Advertisement for Neiman Marcus Gift Card Promotion

Another perk of shopping at Neiman Marcus is the availability of free Shoprunner 2-day shipping on a wide range of items. Furthermore, given Neiman Marcus’s limited physical store presence across the US, sales tax is often not collected for online orders in many states, adding to the potential savings.

Strategic Steps to Leverage Neiman Marcus Promotions

Here’s a breakdown of a successful strategy to maximize these promotional events:

Step 1: Purchasing Neiman Marcus Gift Cards

a white gift card with gold text

a white gift card with gold text

Alt text: Neiman Marcus eGift Card with Gold Lettering for Online Purchases

Historically, a “double-dip” approach has been successful, where shoppers earned rewards both on the purchase and subsequent use of Neiman Marcus eGift cards, despite portal terms often excluding gift card transactions. For example, when Neiman Marcus Amex Offers coincided with Alaska Airlines portal promotions, some users successfully earned miles on gift card purchases. However, it’s worth noting that there have been instances where portals like Alaska have clawed back miles earned on gift card purchases, indicating that this double-dip might not always be guaranteed.

Despite some inconsistencies, anecdotal evidence suggests that earning cashback on eGift card purchases may still be possible. Therefore, the initial step involves purchasing Neiman Marcus eGift cards through a shopping portal. These eGift cards are typically delivered electronically, usually by the afternoon of the next business day, although occasional delays can occur.

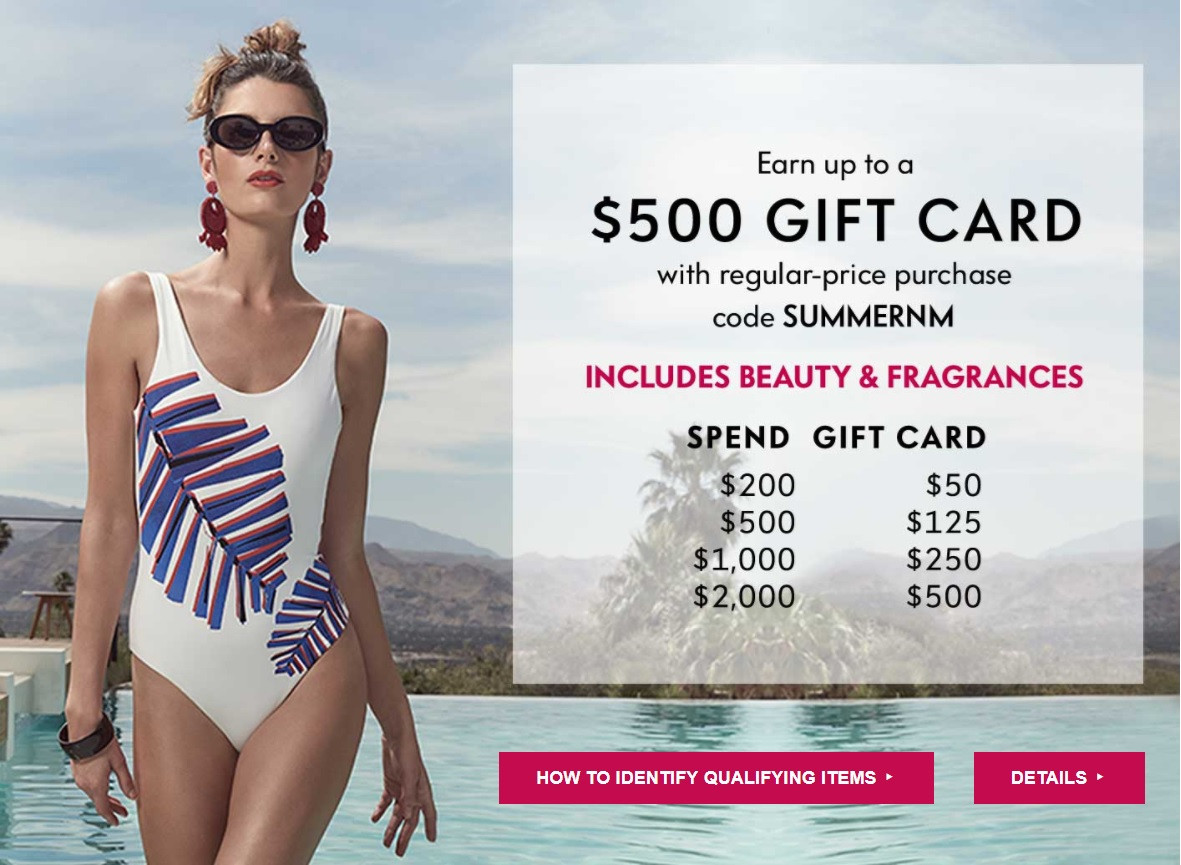

a screenshot of a website

a screenshot of a website

Alt text: Rakuten (formerly Ebates) Shopping Portal Offering 12% Cashback at Neiman Marcus

Currently, shopping portals like Rakuten (formerly Ebates) often offer significant cashback percentages, such as 12%. For those accumulating Membership Rewards points, linking an Amex card to the Amex Offers program can yield an additional 1x point per dollar spent at Neiman Marcus. Utilizing cards like the Blue Business Plus, which earns 2x points on the first $50,000 spent annually, could potentially result in a total of 3x points per dollar (2x base + 1x Amex Offer).

An alternative payment strategy involves using Five Back Visa Gift Cards. These gift cards, available at Simon Malls for a small fee (around $3.95 per $500), effectively offer a 5% discount on purchases. While there’s a nominal activation fee, the rewards earned on credit card purchases of these Visa gift cards often outweigh the fee. Office supply stores like Office Max and Office Depot may also sell variable-load Five Back Visas (up to $200), albeit with higher activation fees, but the 5x/5% rewards earned at these stores can still offset the cost.

The Five Back Visa approach presents a multi-layered benefit:

- Earning rewards on the Visa gift card purchase itself.

- Securing at least 5% cashback on Neiman Marcus eGift card purchases via the Five Back Visa.

- Potentially earning additional cashback through shopping portals when buying the eGift cards.

Portal Terms Disclaimer

It’s crucial to acknowledge that shopping portal terms, like Rakuten’s, often stipulate that cashback is not awarded on gift card purchases or redemptions. While past experiences suggest these terms weren’t always strictly enforced at Neiman Marcus, it’s not a guarantee for future transactions. Tracking issues might arise, and portal assistance may not be provided for non-tracked gift card transactions. Therefore, engaging in this strategy involves a degree of calculated risk.

An example of past successful transactions includes earning cashback on both purchasing and redeeming gift cards at Neiman Marcus through Rakuten.

Alt text: Screenshot Showing Successful Cashback on Neiman Marcus Gift Card Redemption via Rakuten

While past success doesn’t guarantee future payouts, strategically purchasing gift cards remains a potentially rewarding first step, especially when combined with other stacking strategies.

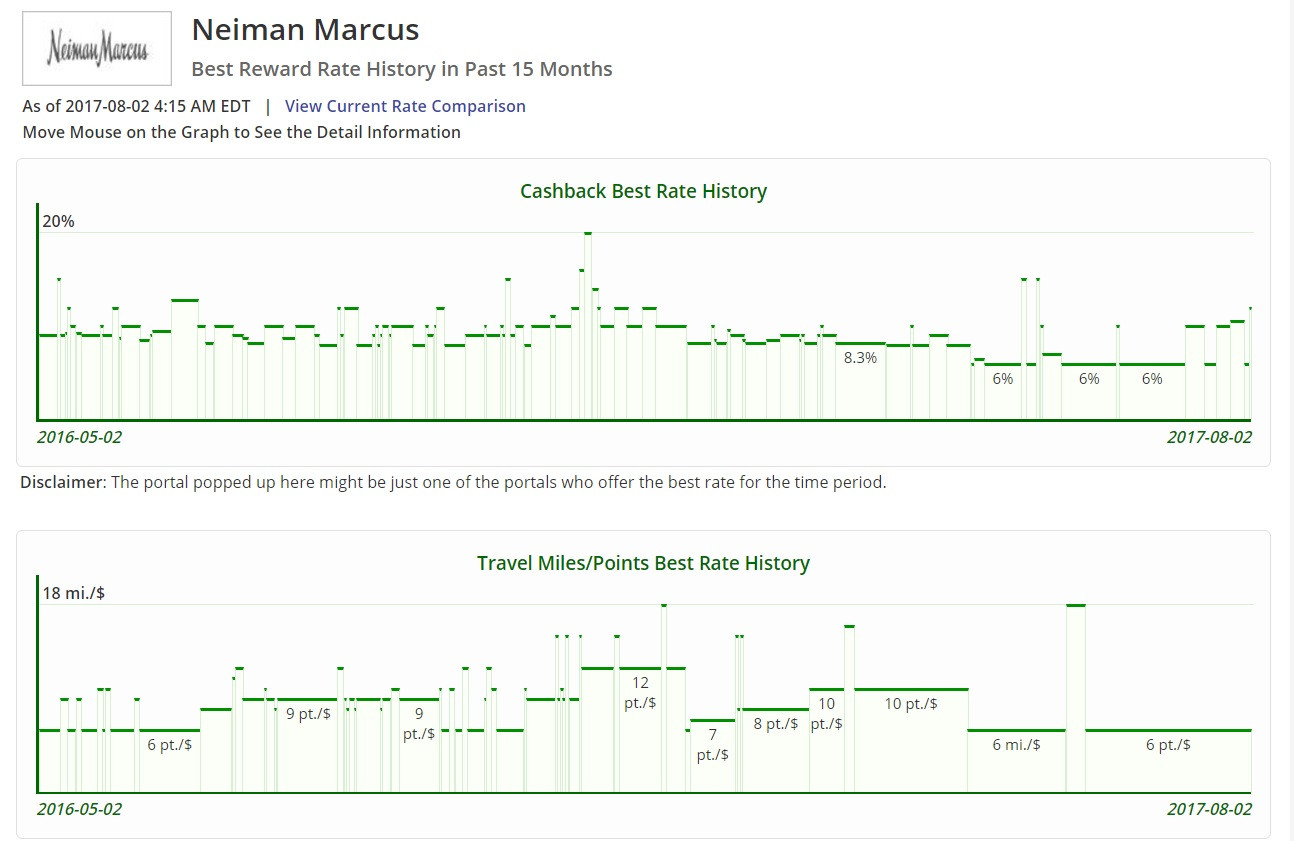

Step 2: Utilizing a Portal for Merchandise Purchases

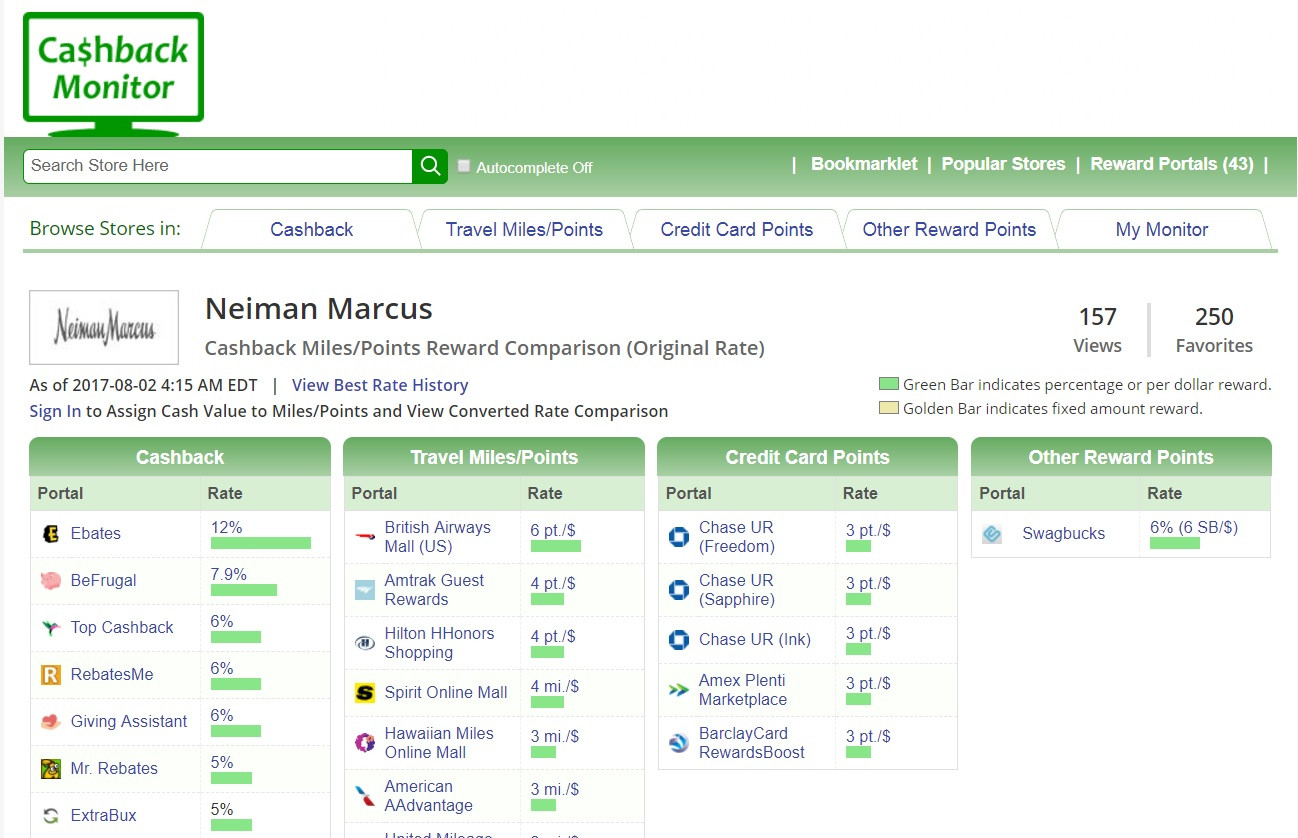

The next phase involves purchasing merchandise using the acquired Neiman Marcus gift cards, again while clicking through a shopping portal. Assuming a $500 merchandise purchase, a 12% cashback rate through Rakuten would yield $60 cashback. While mileage portals might be an option, current cashback rates generally offer a more attractive return.

a screenshot of a credit card points

a screenshot of a credit card points

Alt text: Cashback Monitor Screenshot Displaying 12% Cashback at Neiman Marcus via Rakuten

The challenge lies in selecting reselling items. Finding items that resell for more than the purchase price (e.g., over $500 in this scenario) is unlikely. The goal is to identify items that can be resold for a price as close as possible to the Neiman Marcus price. Reselling inherently carries risk, which differentiates it from traditional manufactured spending. Market fluctuations, demand shifts, and potential difficulties in selling inventory are factors to consider. However, reselling can also be engaging and potentially more profitable than purely manufactured spending, offering the excitement of shopping with a focus on value and return.

Step 3: Redeeming the Promotional Gift Card and Further Portal Usage

Approximately eight weeks after the promotion concludes, and assuming qualifying merchandise was purchased using the relevant promo code (e.g., SUMMERNM), a promotional gift card (e.g., $125 on a $500 spend) will be issued via email. This gift card then becomes another opportunity for savings when used for subsequent purchases through a shopping portal. Even at a conservative 8% cashback rate (based on historical averages from CashBackMonitor), an additional $10 cashback can be earned on a $125 gift card redemption.

a screenshot of a graph

a screenshot of a graph

Alt text: CashBack Monitor 15-Month Cashback History Graph for Neiman Marcus

Historical data reveals that cashback rates can fluctuate, sometimes exceeding 8%. This consistent availability of at least 8% cashback provides a reliable avenue for further savings when utilizing the promotional gift card. The strategy remains consistent: purchase items with the gift card and resell them to recoup costs and potentially generate profit.

Potential Profit Scenarios: Single-Dip vs. Double-Dip

Single-Dip Scenario (Cashback on Merchandise Purchase Only)

Assuming cashback is only earned on the merchandise purchase (and not the initial gift card purchase), and using a Five Back Visa for a $500 merchandise purchase through Rakuten:

- $25 Cashback from Five Back Visa (5%)

- $60 Cashback from Rakuten (12%)

- $10 Cashback on future promotional gift card use (8% estimate)

- $95 Total Cashback

Net cost becomes $500 – $95 = $405 for $625 worth of merchandise ($500 initial + $125 promotional gift card). This equates to acquiring merchandise at approximately 65% of retail price. Profitability hinges on finding reselling items that can fetch more than 65% of the Neiman Marcus price.

Double-Dip Scenario (Cashback on Both Gift Card Purchase and Merchandise Purchase)

If the double-dip (cashback on both gift card purchase and usage) is successful, the profitability significantly increases. Using the same $500 spend and 12% cashback:

- $25 Cashback from Five Back Visa (5% on eGift card purchase)

- $60 Cashback from Rakuten (12% on eGift card purchase)

- $60 Cashback from Rakuten (12% on merchandise purchase using eGift card)

- $10 Cashback on future promotional gift card use (8% estimate)

- $155 Total Cashback

Net cost reduces to $500 – $155 = $345 for $625 in merchandise, bringing the merchandise cost down to roughly 55% of retail. This lower cost basis significantly expands the range of potentially profitable reselling items.

Scaling Up: The “Go Big or Go Home” Approach

Maximizing the promotion by spending the upper limit (e.g., $2,000 to maximize a $500 gift card reward) can further enhance profitability, especially if the double-dip works consistently. For a $2,000 spend at 12% cashback:

- $100 Cashback (Five Back Visa – 5% on $2,000 eGift card purchase)

- $240 Cashback (Rakuten – 12% on eGift card purchase)

- $240 Cashback (Rakuten – 12% on merchandise purchase)

- $40 Cashback (8% estimate on a $500 promotional gift card)

- $620 Total Cashback

Net cost becomes $2,000 – $620 = $1,380 for $2,500 worth of merchandise. The percentage remains around 55% of retail price, but the larger scale allows for diversifying purchases across higher-value items, potentially increasing resale value and ease. Even if the double-dip fails, a net cost of $1,620 for $2,500 in merchandise is still attractive for reselling, although less so given the increased investment and risk. During periods of elevated mileage portal offers (e.g., 15-18 miles per dollar), a mix of cashback and miles might be strategically advantageous. Past instances of double-dipping miles at high rates, coupled with reselling items at around 90% of Neiman Marcus price, have yielded profits of several hundred dollars alongside tens of thousands of miles on a $2,000 purchase.

Exploring Other Neiman Marcus Promotions

Neiman Marcus employs various gift card event structures. Purchase limits can vary (e.g., $1,000 maximum spend), and gift card reward tiers can change (e.g., up to $600 gift card on a $2,000 spend). A useful tactic is to “roll” gift cards from one event into subsequent events, effectively earning further gift card rewards on previously earned gift cards.

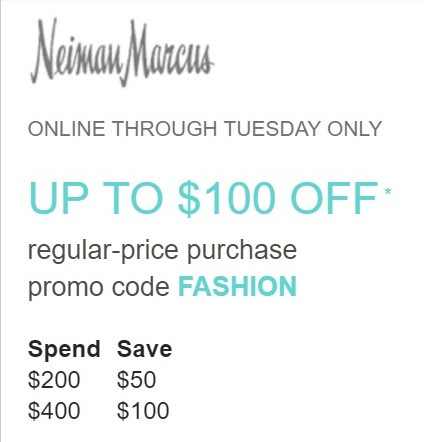

a screenshot of a coupon

a screenshot of a coupon

Alt text: Example Neiman Marcus Coupon for $50 off $200 or $100 off $400 Purchase (Past Promotion)

Beyond gift card events, Neiman Marcus also runs coupon-based promotions, such as fixed dollar-off discounts on specific spending thresholds (e.g., $50 off $200 or $100 off $400). These are particularly advantageous at Neiman Marcus due to their frequent even-dollar pricing. An example of a past successful reselling strategy involved purchasing a specific item priced at $400 (headphones, no longer available at Neiman Marcus) that resold for the same price on Amazon. Buying multiple units and utilizing coupons could create a profitable arbitrage opportunity. By leveraging coupons to further reduce the purchase price, gift cards could be strategically used to acquire inventory at significantly discounted rates, enhancing profit margins with minimal effort, especially when utilizing fulfillment services like Amazon FBA.

Identifying Resellable Merchandise

The critical question for resellers is: What to buy? Providing specific product recommendations is challenging and quickly becomes outdated due to market saturation. The key is to understand the underlying math: targeting items that can be resold for more than 55-65% of the Neiman Marcus price, depending on the success of the double-dip. Experimentation across different product categories is essential to identify profitable niches. Past successful reselling categories have included housewares, small appliances, silverware, electronics, and fragrances, among others. While bulk purchasing a single, known profitable item can be tempting, diversifying across different items mitigates risk.

Important Caveats

Engaging in these strategies involves inherent risks and considerations:

- Portal Terms Violation: Purchasing and redeeming gift cards through portals may violate their terms of service, potentially leading to cashback being denied. While past experiences suggest leniency, it’s not guaranteed.

- Order Cancellations: Neiman Marcus reserves the right to cancel orders. While infrequent, cancellations can impact profitability, especially if it drops the order below a gift card reward threshold. Backordered items are particularly susceptible to cancellation.

- Reselling Risks: Reselling entails risks like lost or damaged items, fraudulent returns, and market price fluctuations. While generally positive, reselling is not risk-free and requires careful management. New resellers should start small and only risk capital they can afford to lose.

Bottom Line

Neiman Marcus presents a compelling, albeit nuanced, opportunity for resellers. While cashback portal terms regarding gift cards introduce an element of uncertainty, strategic execution can still be profitable. While the immediate sale discussed in the original article may have ended, signing up for Neiman Marcus email alerts (perhaps using a dedicated spam email address due to high email frequency) is crucial for staying informed about upcoming promotions. The advantage of Neiman Marcus lies in the potential to discover less saturated reselling niches compared to more mainstream retailers, potentially improving profit margins through reduced competition.

Interested in maximizing miles and points? Subscribe for email updates or explore our podcast on your preferred platform.