Great news for those looking to boost their college savings! Gift Of College has recently announced a significant update, removing the daily limits on gift card redemptions. This is a welcome change for anyone utilizing Gift of College gift cards to fund 529 plans, offering a smoother and more flexible experience. Previously, users faced a daily redemption cap, but now, you have the freedom to redeem your Gift of College gift cards without these restrictions. Let’s dive into what this means for you and your college savings goals.

a gift card and a card

a gift card and a card

Understanding Gift of College and 529 Plans

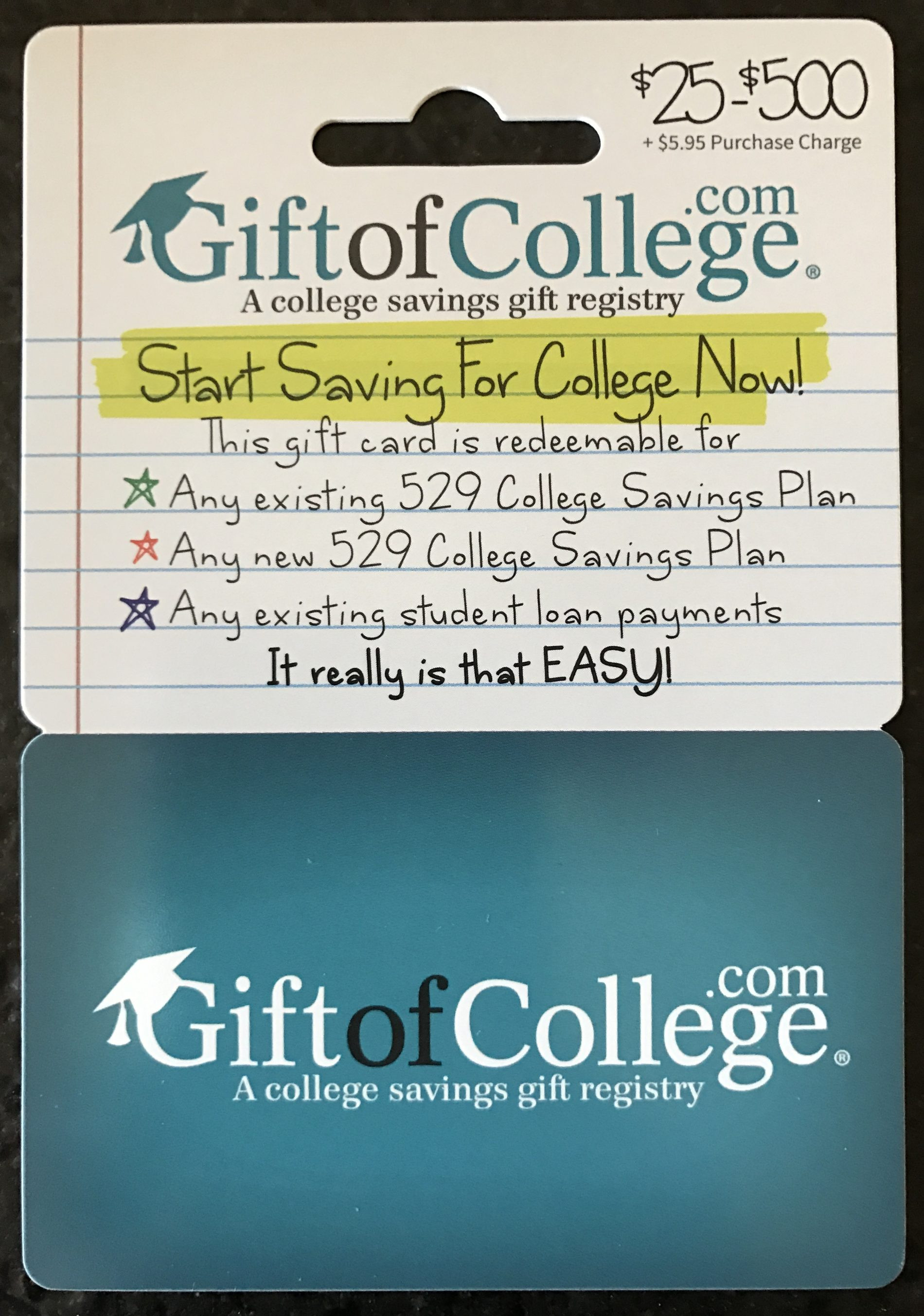

For those new to the concept, Gift of College provides an innovative way to contribute to 529 college savings plans and student loan accounts. Essentially, Gift of College gift cards can be purchased and then redeemed into these education savings vehicles. This opens up opportunities to indirectly use credit cards for funding 529 plans, which can be particularly advantageous for earning credit card rewards points and miles. Financial experts and bloggers, like those at Frequent Miler, have extensively covered the benefits of using Gift of College, highlighting it as a strategic tool for maximizing rewards while saving for education expenses.

While Gift of College gift cards might not be available everywhere, they present a valuable option when accessible. The initial announcement of a $2,000 daily redemption limit caused some concern among users who planned to make larger contributions or redeem multiple cards at once. This limit, though intended to align with typical gift card purchase regulations, posed an inconvenience for users seeking to efficiently fund their 529 plans.

The Initial Daily Limit and User Experience

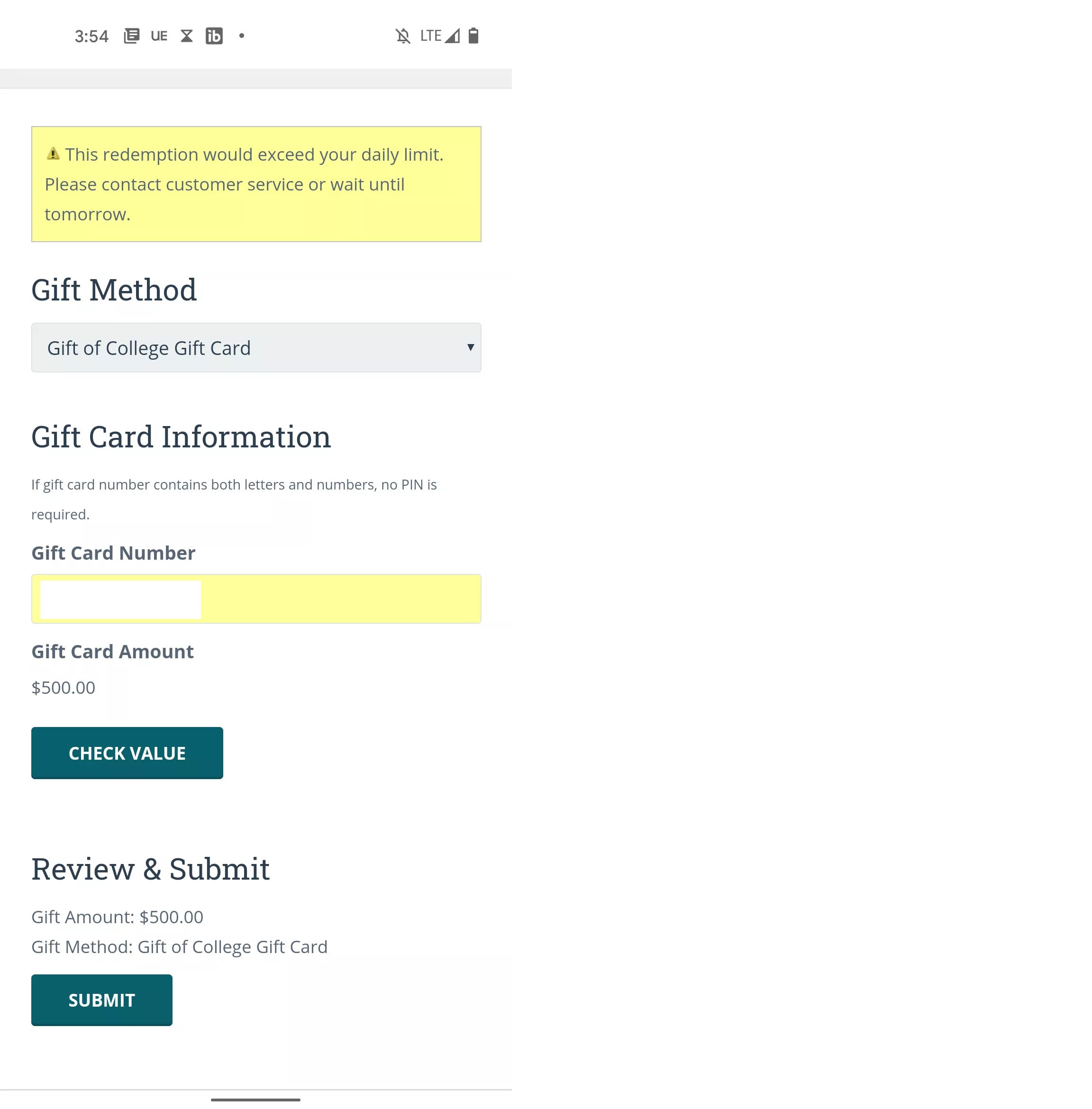

The introduction of a daily redemption limit meant that users could only load up to $2,000 worth of gift cards into their Gift of College accounts per day. This restriction became apparent when attempting to redeem gift cards exceeding this amount. For instance, imagine having several Gift of College gift cards accumulated and trying to deposit them into your children’s 529 plans. If the total value exceeded $2,000 in a single day, the transaction would be halted, requiring multiple redemption sessions across different days.

This limitation was encountered firsthand when attempting to load gift cards previously purchased for college savings. After successfully redeeming $2,000, an attempt to add a further $500 resulted in an error message, indicating the imposed daily cap. Upon contacting Gift of College, confirmation was received that this $2,000 daily limit was indeed a new policy for gift card redemptions, citing alignment with gift card purchase regulations.

a screenshot of a gift card

a screenshot of a gift card

This approach was perceived as somewhat unusual, as limiting the redemption of already purchased gift cards differed from typical purchase limits at the point of sale. It raised questions about the user experience, especially for families managing multiple 529 accounts or those receiving Gift of College gift cards as actual gifts. The limit appeared to apply per Gift of College login, potentially affecting families with multiple beneficiaries under a single account.

Redemption Limits Lifted: A Positive Turn

Fortunately, Gift of College has responded to user feedback and reassessed this policy. The daily redemption limits have now been lifted, marking a significant positive change. This reversal means users can once again redeem their Gift of College gift cards without being restricted by daily caps, providing greater flexibility and convenience in funding college savings.

This update simplifies the process for everyone, whether you’re making regular contributions or looking to deposit a larger sum. While a purchase limit of $2,000 per day might still be in place at the retail level (depending on store policies), the removal of redemption limits directly addresses the user experience concern and streamlines the process of funding 529 plans with Gift of College gift cards.

Why This Update Matters for College Savers

The removal of the daily redemption limit is particularly beneficial for several reasons. Firstly, it simplifies the contribution process, especially for those who prefer to make less frequent but larger deposits. Secondly, it accommodates situations where individuals might receive Gift of College gift cards as gifts and wish to redeem them promptly. Furthermore, for those in states offering tax deductions for 529 contributions, the ability to make larger, lump-sum contributions without daily limits can be advantageous for maximizing tax benefits.

While the initial daily limit posed a minor hurdle, its removal underscores Gift of College’s commitment to providing a user-friendly and effective way to save for college. Even though local availability of Gift of College gift cards may vary, and contribution amounts differ, this policy change makes the process more seamless for all users. So, if you are exploring ways to leverage credit card rewards for college savings or seeking flexible options for 529 plan funding, Gift of College, now without redemption limits, remains a valuable tool.